Contents

The world of investing can seem intimidating, especially for beginner investors. But fear not, aspiring investor! By cultivating the right habits, you can navigate the market with confidence and build a solid foundation for your financial future. Here are 7 habits of highly effective beginner investors to inspire your journey:

Embrace Continuous Learning as a Beginner Investor

Knowledge is power. Commit to ongoing learning by reading books, taking investment courses, and following credible financial resources. The more you understand the market, the more informed decisions you can make.

Real-life example: Michael Batnick, founder of The Financial Diet website, started his investment journey with limited knowledge. He actively sought to learn by reading books like “I Will Teach You to Be Rich” and “The Simple Path to Wealth,” taking online courses, and consuming educational content from reputable financial websites. This continuous learning equipped him with the knowledge and confidence to manage his investments and build wealth.

If you are interested, here you can find our suggestion for 5 Must-Read Books to Launch Your Investment Journey: From Beginner to Financially Free.

Other Trusted Resources: The National Endowment for Financial Education (https://www.nefe.org/) offers a wealth of free resources on various financial topics, including investing.

Start Early and Invest Consistently

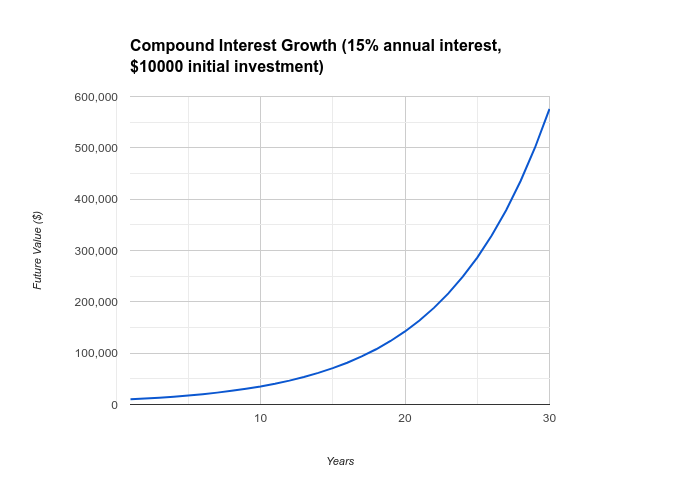

Time is your greatest ally in the investment game especially for beginner investors. Starting early allows you to benefit from the power of compounding interest. Even small, consistent investments can grow significantly over time.

Real-life example: Kristine Wong: Inspired by her financially savvy grandmother, Kristine began investing a small portion of her salary into a low-cost index fund through a robo-advisor platform as soon as she started working. Despite starting with a small amount, her consistent monthly contributions, combined with the power of compound interest, helped her build a significant nest egg over time.

Here example of investing just $10000 for 30 years with 15% annual interest. You can easily see the power of compounding!

Trusted Resource: The Investor.gov website (https://www.investor.gov/) provides a comprehensive guide to compound interest, explaining its concept and offering easy-to-use calculators to understand its impact on your investments.

Develop a Long-Term Vision

Investing isn’t a get-rich-quick scheme. Focus on building long-term wealth by setting realistic goals and developing a clear investment strategy aligned with your time horizon and financial objectives.

Trusted Resource: The Vanguard website (https://investor.vanguard.com/home) offers various resources on asset allocation strategies for different investment goals and timeframes.

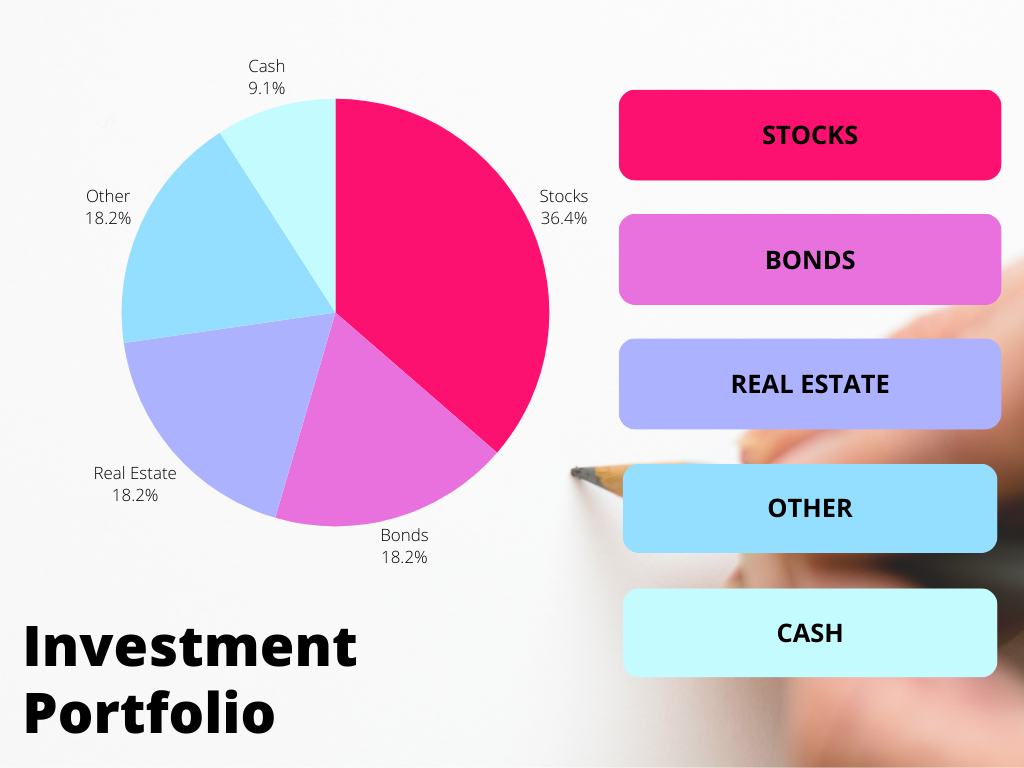

Master the Art of Diversification

Don’t put all your eggs in one basket! Diversify your portfolio across different asset classes (stocks, bonds, real estate) to mitigate risk. This helps minimize the impact of market downturns on your overall investment performance.

Real-life example: Warren Buffett: Widely considered one of the greatest investors of all time, Warren Buffett is known for his value investing philosophy and emphasis on diversification. He encourages investors to spread their investments across various asset classes and industries to mitigate risk and achieve long-term growth.

Trusted Resource: The Securities and Exchange Commission (SEC) website (https://www.sec.gov/) provides educational resources on investment diversification, explaining its benefits and different diversification strategies.

Very important for Beginner Investors: Control Your Emotions

The market has its ups and downs. Don’t let fear or excitement dictate your investment decisions. Develop a disciplined approach and stick to your long-term plan, even amidst market fluctuations.

Trusted Resource: The Khan Academy website (https://www.khanacademy.org/economics-finance-domain/core-finance) offers a free course on behavioral finance, exploring how emotions can influence investment decisions and strategies to manage them effectively.

Seek Guidance from Professionals

Don’t be afraid to seek guidance from qualified financial advisors. A professional can help you analyze your risk tolerance, develop an investment strategy, and navigate complex financial decisions.

Real-life example: Michael Brown, a beginner investor, consulted a fee-only financial advisor to discuss his investment goals and risk tolerance. The advisor helped him create a personalized investment plan and recommended suitable investment options based on his individual needs and circumstances.

Trusted Resource: The Garrett Planning Network (https://www.garrettplanningnetwork.com/) can help you find a qualified fee-only financial advisor in your area.

Celebrate Milestones and Embrace Mistakes:

Investing is a journey with both successes and setbacks. Celebrate your milestones, big and small, to stay motivated. Learn from your mistakes, adjust your strategy accordingly, and keep moving forward.

Remember: This article is for informational purposes only and does not constitute financial advice. Consulting a qualified financial advisor is crucial before making any investment decisions.