Contents

ETFs, or Exchange-Traded Funds, have revolutionized the way we invest. Offering the diversification of a mutual fund coupled with the ease of trading a stock, ETFs are a powerful tool for investors aiming to build robust, diversified portfolios. Here’s an in-depth exploration into ETFs and how to leverage them for substantial financial gains.

Key Takeaways

| Point | Summary |

|---|---|

| ETF Understanding | ETFs offer diversification, lower expense ratios, and flexibility. |

| Global Trends | 2024 promises significant shifts in ETF allocations and sectors. |

| Performance Metrics | Evaluating ETFs requires understanding their performance categories and financial metrics. |

| Investment Strategies | Choosing the right ETF involves analyzing expense ratios and dividend yields. |

| Getting Started | Investing in ETFs involves a strategic approach to purchase and manage your investments effectively. |

Introduction to ETFs

ETFs have surged in popularity, becoming a favored investment vehicle for their versatility and potential for portfolio diversification. They can play a crucial role in achieving financial freedom and are renowned for their ability to spread investment across numerous assets.

The rise of ETFs reflects the evolving landscape of investment, where flexibility and strategic diversification reign supreme. This article will navigate through the basics of ETFs, explore the various categories available, underscore critical financial metrics worth considering, and provide a detailed guide on making your first ETF investment.

Understanding ETFs

ETFs are akin to baskets of securities bought or sold through an exchange, mirroring the performance of underlying indexes like the S&P 500. They span various asset classes, from traditional stocks and bonds to more niche markets like commodities or cryptocurrencies.

Find more about ETFs in this article: https://www.investopedia.com/terms/e/etf.asp

The allure of ETFs lies in their ability to offer investors comprehensive exposure to diverse markets. Lower expense ratios compared to mutual funds and the flexibility to trade like stocks make ETFs attractive options for both novice and seasoned investors.

The Global Landscape of ETFs in 2024

As we look to 2024, notable shifts in geographical allocations and sectors present fresh outlooks for ETF investors. Sectors such as technology, healthcare, and sustainable energy are witnessing substantial growth, reflecting broader economic trends and consumer interests.

Key ETF Categories and Their Performance

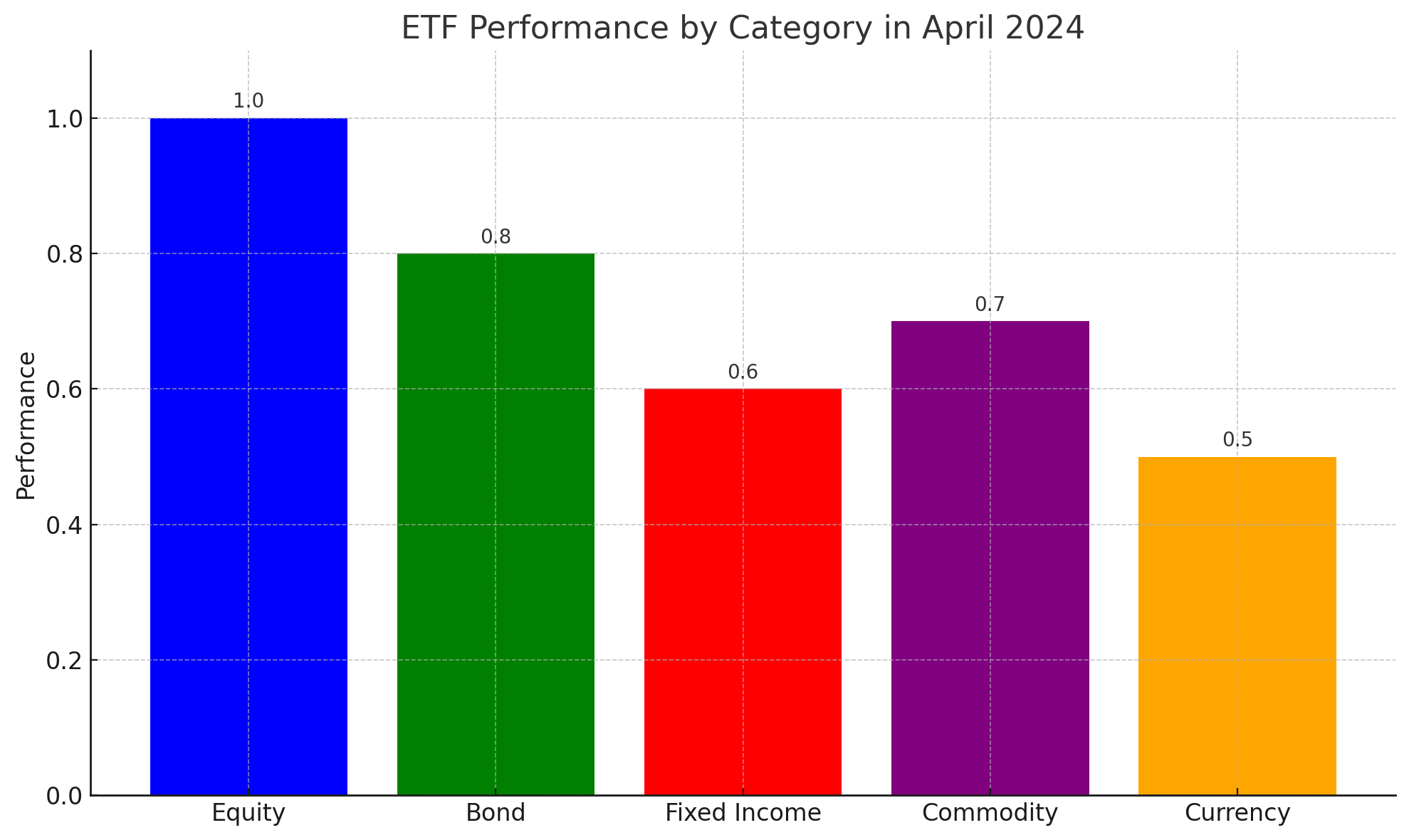

ETFs are categorized into equity, bond, fixed income, commodity, and currency, each offering unique benefits based on market performance. For example, equity ETFs provide a stake in company stocks, offering the potential for growth, while bond ETFs offer more stable, income-generating investments.

Analyzing the performance of these categories helps investors identify opportunities and risks associated with each type, enabling informed decision-making when building an investment portfolio.

Learn more about diverse investment strategies with Top 10 Investment Strategies for Beginners.

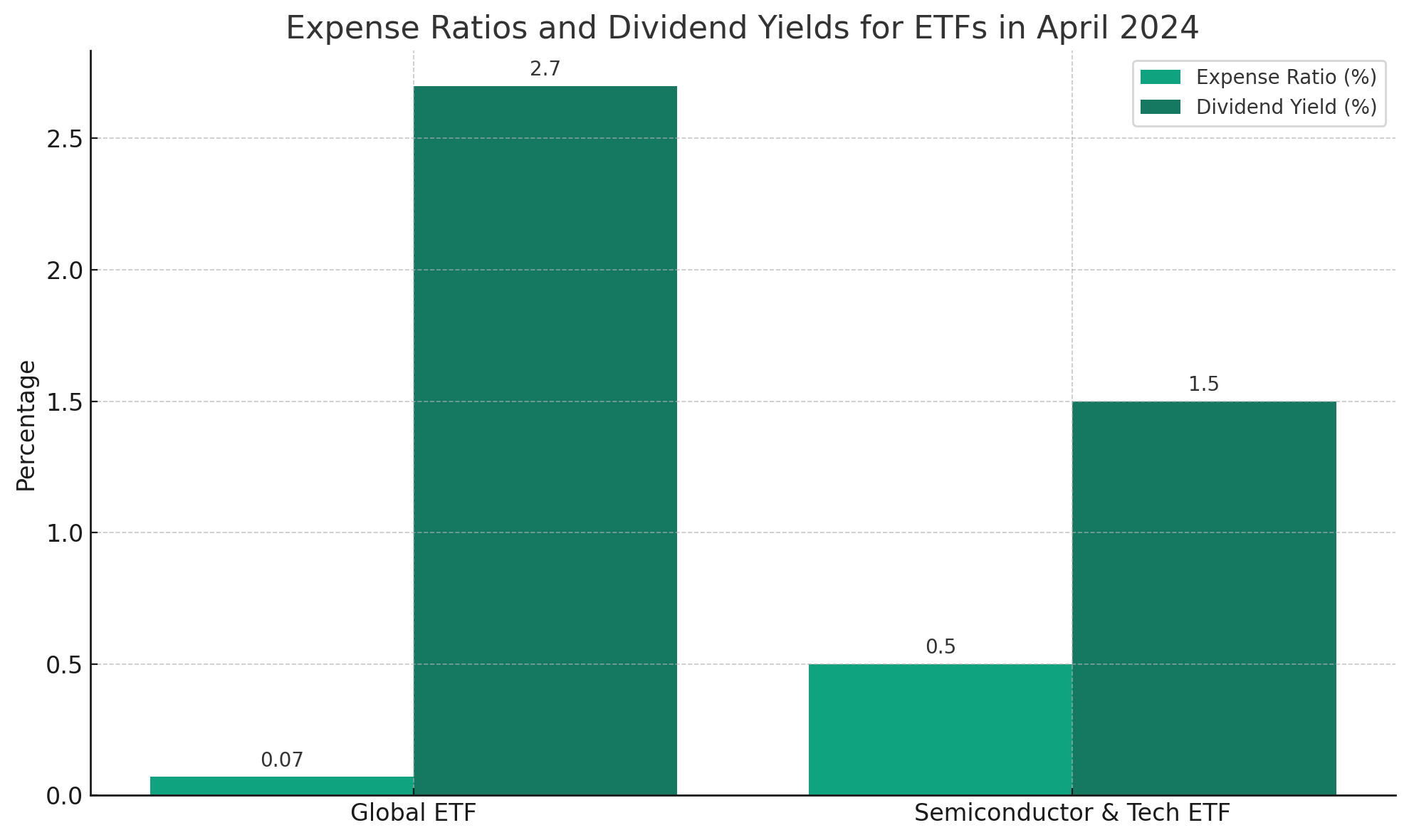

Financial Metrics of Importance

Critical to ETF investment is understanding key financial metrics such as expense ratios and dividend yields. Expense ratios represent the annual costs associated with managing the ETF, impacting overall returns. Dividend yields, on the other hand, indicate the income generated from the investment, offering insights into the ETF’s profitability.

How to Start Investing in ETFs

Investing in ETFs starts with identifying your financial goals and risk tolerance. Once determined, researching to find the ones that align with your objectives is crucial. Utilizing online platforms or brokers can simplify the process, allowing for the purchase of ETF shares similar to stocks.

Managing ETF investments involves regular reviewing and rebalancing your portfolio to ensure it aligns with your investment objectives and market conditions. Diversifying across various sectors can also mitigate risks while potentiating returns.

Strengthen your investment portfolio through diversification: The Power of Diversification: Building a Strong Investment Portfolio.

Conclusion

ETFs stand out as a formidable investment tool, offering the versatility, ease, and diversification needed to tackle today’s dynamic market landscape. Whether you’re starting your investment journey or looking to refine your portfolio, ETFs offer a pathway to achieving your financial goals with informed precision.

Embarking on the this investment journey equips you with the necessary tools to navigate the complexities of the financial market, ensuring a prosperous and financially secure future.

Ready to unlock the secrets of successful investing? Get now FOR FREE our MODULE I of our course, “Intelligent Investing Essentials: A Beginner’s Guide to Benjamin Graham’s ‘The Intelligent Investor’!”. Delve into the timeless wisdom of one of the greatest investment minds and learn how to apply Benjamin Graham’s principles to your own portfolio. Gain invaluable insights, practical strategies, and actionable techniques to navigate the markets with confidence and clarity. Don’t miss out on this opportunity to master the fundamentals of intelligent investing – enroll today and embark on your journey to financial freedom!