Contents

In 2024, understanding the magic of compound interest remains pivotal in navigating the complexities of personal financial management. It’s not just a concept reserved for the financially savvy; it’s a fundamental principle that can significantly amplify wealth over time for anyone willing to learn and apply its rules. Below is a quick overview of the key points we will cover in this article.

Key Takeaways

| Key Concept | Description |

|---|---|

| Compound Interest Definition | Interest calculated on the initial principal and also on the accumulated interest. |

| Compound Frequency | More frequent compounding (e.g., daily, monthly) results in greater interest accumulated. |

| Regular Contributions | Consistent contributions significantly boost the power of compound interest. |

| Investment Vehicles | Different vehicles like high-yield savings accounts, stocks, and CDs cater to diverse goals. |

| Long-Term Returns | Longer investment horizons usually yield higher returns thanks to compounding. |

By breaking down the concept of compound interest, we hope to instill a more profound respect and understanding for this financial phenomenon and demonstrate how regular contributions can potentially lead to substantial wealth accumulation.

Introduction to Compound Interest

Compound interest, simply put, is interest on interest. This magical financial concept allows your wealth to grow exponentially over time. Imagine planting a financial seed and watching it sprout into a towering tree. That’s compound interest at work!

For those looking to dive deeper into the best accounts for earning compound interest, Forbes Advisor offers a comprehensive guide.

Understanding Compound Interest

At its core, compound interest works by applying interest not only to the initial amount deposited or borrowed but also to any interest already accrued. As a result, the amount of interest earned grows at an accelerating rate. The formula to calculate annual compound interest is a perfect demonstration of this exponential growth:

Final Amount = Principal Amount * (1 + Interest Rate/Compound Periods)^(Compound Periods*Time)

Consider an example where $1,000 is invested at an annual interest rate of 5%, compounded annually. After one year, this investment would grow to $1,050. However, thanks to the magic of compound interest, after 20 years, it would balloon to $2,653.30, assuming no additional contributions are made.

For a detailed explanation and examples of how compound interest works, including calculators to visualize growth over time, see Investopedia.

The Effect of Compounding Frequency

The frequency of compounding can significantly influence the total amount of interest accrued. The more frequently interest is compounded, the more interest will be earned on that interest, leading to greater wealth over time. Whether your interest is compounded annually, monthly, or daily can make a big difference in the long run.

Harnessing the Power of Compound Interest with Regular Contributions

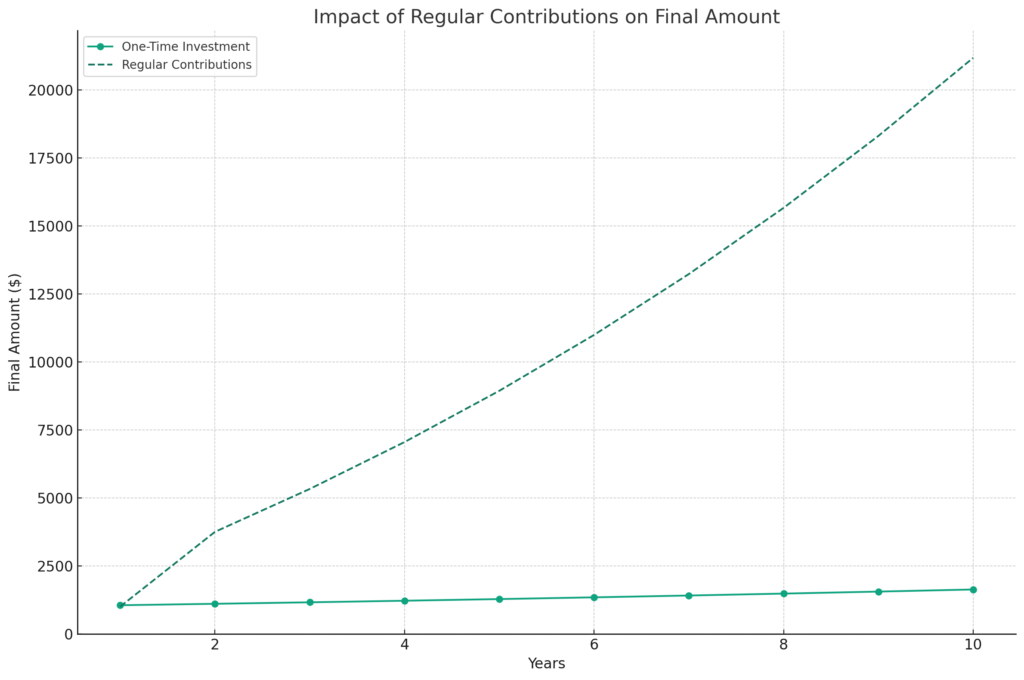

One of the most effective strategies to capitalize on the power of compound interest is through regular contributions. By continuously investing money over time, you contribute to the principal, which, in turn, earns more interest. This cyclical process can significantly accelerate your journey to financial freedom.

To understand the impact of regular contributions on compound interest, Wells Fargo provides hypothetical examples illustrating the long-term exponential growth potential.

Choosing the Right Savings or Investment Vehicle

Exploring different savings or investment vehicles is crucial to maximizing the benefits of compound interest. While high-yield savings accounts, money market accounts, and CDs offer safety and steady growth, riskier investments like stocks, ETFs, and alternative investments may promise higher returns. The key is to align these choices with your individual risk tolerance and financial goals.

Conclusion

The concept of compound interest is both powerful and empowering. Starting early, making regular contributions, and choosing the appropriate investment vehicles can harness this financial force to achieve profound long-term growth.

Remember, the performance of various investments can fluctuate, and their suitability depends on an individual’s financial situation and goals. Conducting thorough research and potentially consulting a financial advisor is advisable before making any significant investment decisions.

The journey to leveraging the magic of compound interest starts with a single step—understanding its power and integrating it into your financial strategy can unlock immense potential for wealth accumulation over time.

Ready to unlock the secrets of successful investing? Get now FOR FREE our MODULE I of our course, “Intelligent Investing Essentials: A Beginner’s Guide to Benjamin Graham’s ‘The Intelligent Investor’!”. Delve into the timeless wisdom of one of the greatest investment minds and learn how to apply Benjamin Graham’s principles to your own portfolio. Gain invaluable insights, practical strategies, and actionable techniques to navigate the markets with confidence and clarity. Don’t miss out on this opportunity to master the fundamentals of intelligent investing – enroll today and embark on your journey to financial freedom!